So, you've probably heard the term "annuity payout calculator" floating around in financial circles or maybe even stumbled upon it while scrolling through your social media feed. But what exactly is this thing, and why should you care? Think of it like a secret weapon for anyone planning their financial future. Whether you're saving up for retirement, planning a dream vacation, or just trying to make sense of your finances, an annuity payout calculator can be your best friend. Stick around because we're about to break it down in a way that even your grandma could understand.

Now, before we dive headfirst into the nitty-gritty, let’s talk about why this little tool is such a big deal. Annuity payout calculators aren’t just for finance geeks or people wearing suits in Wall Street. They’re for everyday folks like you and me who want to know exactly how much money we’ll be getting on a regular basis. It’s all about clarity, control, and confidence in your financial future. Sound good? Let’s get started.

Before we move forward, let’s set the stage. This guide isn’t just another boring article full of jargon and complicated terms. We’re here to make sure you leave with a clear understanding of how annuity payout calculators work, why they matter, and how you can use them to your advantage. So grab a cup of coffee, sit back, and let’s demystify the world of annuities together.

Read also:Gabrielle Dennis Spouse The Untold Love Story

What Exactly is an Annuity Payout Calculator?

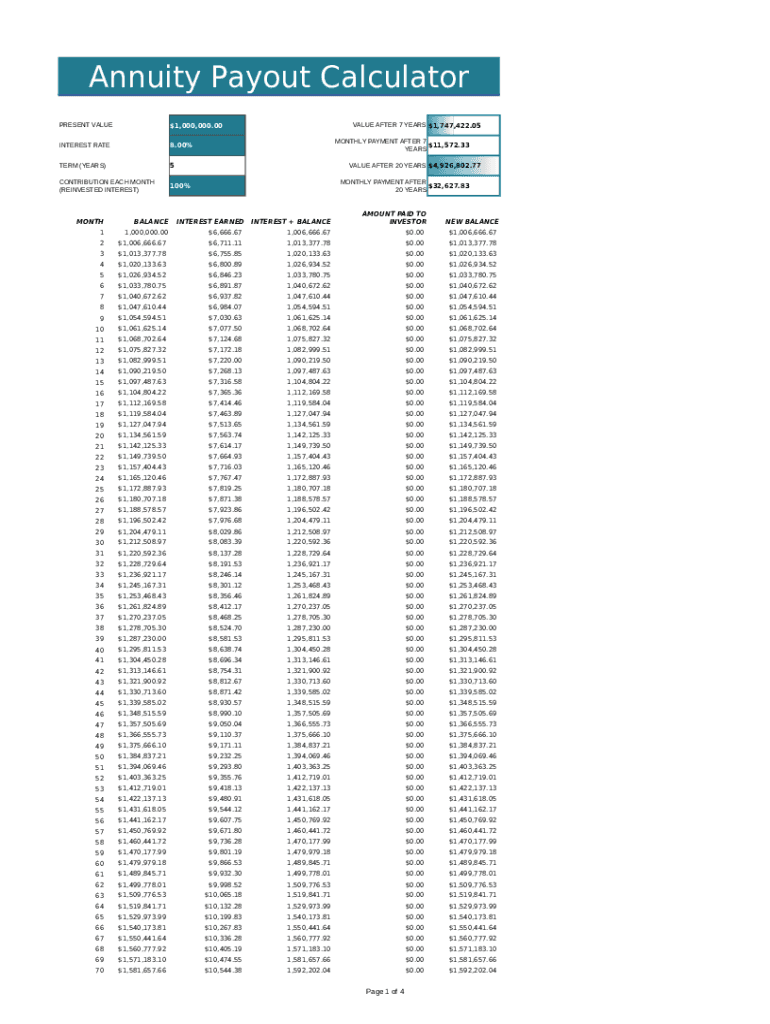

Alright, let’s start with the basics. An annuity payout calculator is essentially a tool that helps you figure out how much money you’ll receive from an annuity over time. Think of it as a financial crystal ball that gives you a glimpse into your future income. It takes into account factors like the amount of money you’ve invested, the interest rate, the payout period, and even your age. Pretty cool, right?

Here’s the thing though—annuities can get pretty complex, especially when you start throwing in terms like "fixed annuity," "variable annuity," and "immediate annuity." But don’t worry, the calculator does all the heavy lifting for you. All you need to do is input some basic details, and voila! You’ve got a clear picture of what your future payouts might look like.

Why Should You Care About Annuity Payouts?

Let’s face it—money is a big deal. And when it comes to planning for the future, knowing how much you’ll have coming in every month or year can make all the difference. Annuity payouts are especially important for people who are nearing retirement or anyone looking for a steady source of income. It’s like having a financial safety net that ensures you won’t run out of cash when you need it most.

But here’s the kicker—without a payout calculator, figuring out these numbers can be a nightmare. You’d have to crunch numbers, deal with formulas, and probably end up with a headache. The calculator simplifies everything, giving you a clear, easy-to-understand breakdown of your potential payouts. And who doesn’t love simplicity, right?

How Does an Annuity Payout Calculator Work?

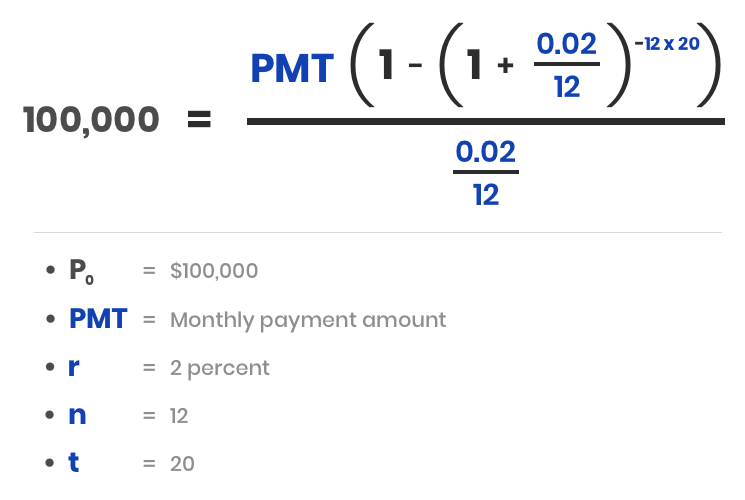

Now that we’ve established why annuity payout calculators are awesome, let’s talk about how they actually work. At its core, the calculator uses a bunch of fancy math to estimate your future payouts. But don’t panic—we’re not going to dive into calculus or anything like that. Instead, let’s break it down into simple terms.

The calculator takes into account several key factors:

Read also:Remote Iot Vpc Review Your Ultimate Guide To Secure And Scalable Connectivity

- Initial Investment: How much money you’ve put into the annuity.

- Interest Rate: The rate at which your investment grows over time.

- Payout Period: How long you want to receive payments.

- Age: Your current age (yes, it matters!).

Once you’ve entered these details, the calculator does its magic and spits out an estimate of your monthly or yearly payouts. It’s like having a personal financial assistant without the hefty price tag.

Key Features of an Annuity Payout Calculator

Not all annuity payout calculators are created equal. Some are basic, while others come packed with advanced features. Here are a few things you might find:

- Customizable Payout Periods: Want to know what your payouts would look like if you stretched them out over 10 years instead of 20? No problem.

- Multiple Annuity Types: Some calculators allow you to compare fixed, variable, and immediate annuities side by side.

- Inflation Adjustments: Fancy calculators can even factor in inflation to give you a more realistic estimate of your future income.

Understanding Different Types of Annuities

Before we move on, let’s take a quick detour to talk about the different types of annuities. Why? Because the type of annuity you choose can have a big impact on your payouts. Here’s a quick rundown:

Fixed Annuities

Fixed annuities offer a guaranteed rate of return. Think of them like a savings account, but with potentially higher interest rates. They’re a great option if you want stability and predictability in your payouts.

Variable Annuities

Variable annuities, on the other hand, are a bit more risky. Your payouts depend on how well the underlying investments perform. It’s like playing the stock market, but with a safety net. If the market does well, your payouts could be higher. But if it tanks, you might end up with less than you expected.

Immediate Annuities

Immediate annuities are perfect for people who need income right away. You pay a lump sum upfront, and in return, you start receiving payments immediately. It’s like a paycheck for life, but you have to cough up the cash first.

Benefits of Using an Annuity Payout Calculator

Now that we’ve covered the basics, let’s talk about why you should be using an annuity payout calculator. Here are a few key benefits:

- Clarity: Get a clear picture of your future payouts without all the guesswork.

- Customization: Experiment with different scenarios to see what works best for you.

- Peace of Mind: Knowing exactly how much money you’ll have coming in can help you sleep better at night.

And let’s not forget—it’s free! Most annuity payout calculators are available online, and you don’t have to pay a dime to use them. So why not give it a shot?

Common Mistakes to Avoid

While annuity payout calculators are incredibly useful, they’re not without their pitfalls. Here are a few common mistakes to watch out for:

- Overestimating Returns: Don’t get too excited about high interest rates. They might not always pan out the way you expect.

- Ignoring Inflation: Failing to account for inflation can leave you with less purchasing power down the line.

- Not Comparing Options: Don’t settle for the first annuity you come across. Shop around and compare different options to find the best fit for your needs.

Real-Life Examples

To make things even clearer, let’s look at a couple of real-life examples. Meet John and Sarah—two everyday folks who used an annuity payout calculator to plan their financial futures.

John’s Story

John is 65 years old and has $500,000 saved up for retirement. He uses an annuity payout calculator to estimate his monthly payouts over a 20-year period. After crunching the numbers, he discovers that he can expect around $2,500 per month. Armed with this information, John can now plan his retirement budget with confidence.

Sarah’s Story

Sarah is 50 years old and wants to know how much she’ll need to save for retirement. Using the calculator, she experiments with different scenarios and realizes that she’ll need to save an additional $100,000 to meet her goals. With this knowledge, Sarah can adjust her savings plan accordingly.

Expert Tips for Maximizing Your Annuity Payouts

Ready to take your annuity game to the next level? Here are a few expert tips to help you maximize your payouts:

- Start Early: The earlier you start investing in an annuity, the more time your money has to grow.

- Shop Around: Different providers offer different rates and terms. Do your research and find the best deal.

- Consider Joint Annuities: If you’re married or have a partner, a joint annuity can provide income for both of you, even after one passes away.

Conclusion: Take Action Today

There you have it—the ultimate guide to annuity payout calculators. Whether you’re planning for retirement, saving for a rainy day, or just trying to make sense of your finances, these tools can be invaluable. So what are you waiting for? Head over to your favorite annuity payout calculator and start crunching those numbers. And don’t forget to share this article with your friends and family—knowledge is power, after all.

Call to Action: Got questions or feedback? Drop a comment below, and let’s keep the conversation going. Your financial future is too important to ignore, so take action today!