Property taxes can be a tricky subject, especially when you're dealing with Loudoun County. But don't sweat it, because we're here to break it down for you in a way that’s easy to digest. Whether you're a homeowner, investor, or just curious about how tax assessments work in Loudoun, this article’s got you covered. So grab a cup of coffee, sit back, and let’s dive into everything you need to know about Loudoun tax assessment!

Let’s face it—taxes are one of those things no one really enjoys thinking about. But when it comes to your property, understanding the Loudoun tax assessment process is crucial. It affects your wallet, your home value, and your overall financial planning. So why not make it less intimidating? We’ll walk you through the basics, the nitty-gritty details, and some tips to help you navigate the system like a pro.

By the end of this article, you’ll have a solid grasp on how Loudoun tax assessments work, what factors influence them, and how you can potentially save money. Stick around, and let’s tackle this together!

Read also:Unlocking The Potential Of Remoteiot Platform Ssh Key Free Your Ultimate Guide

What is Loudoun Tax Assessment?

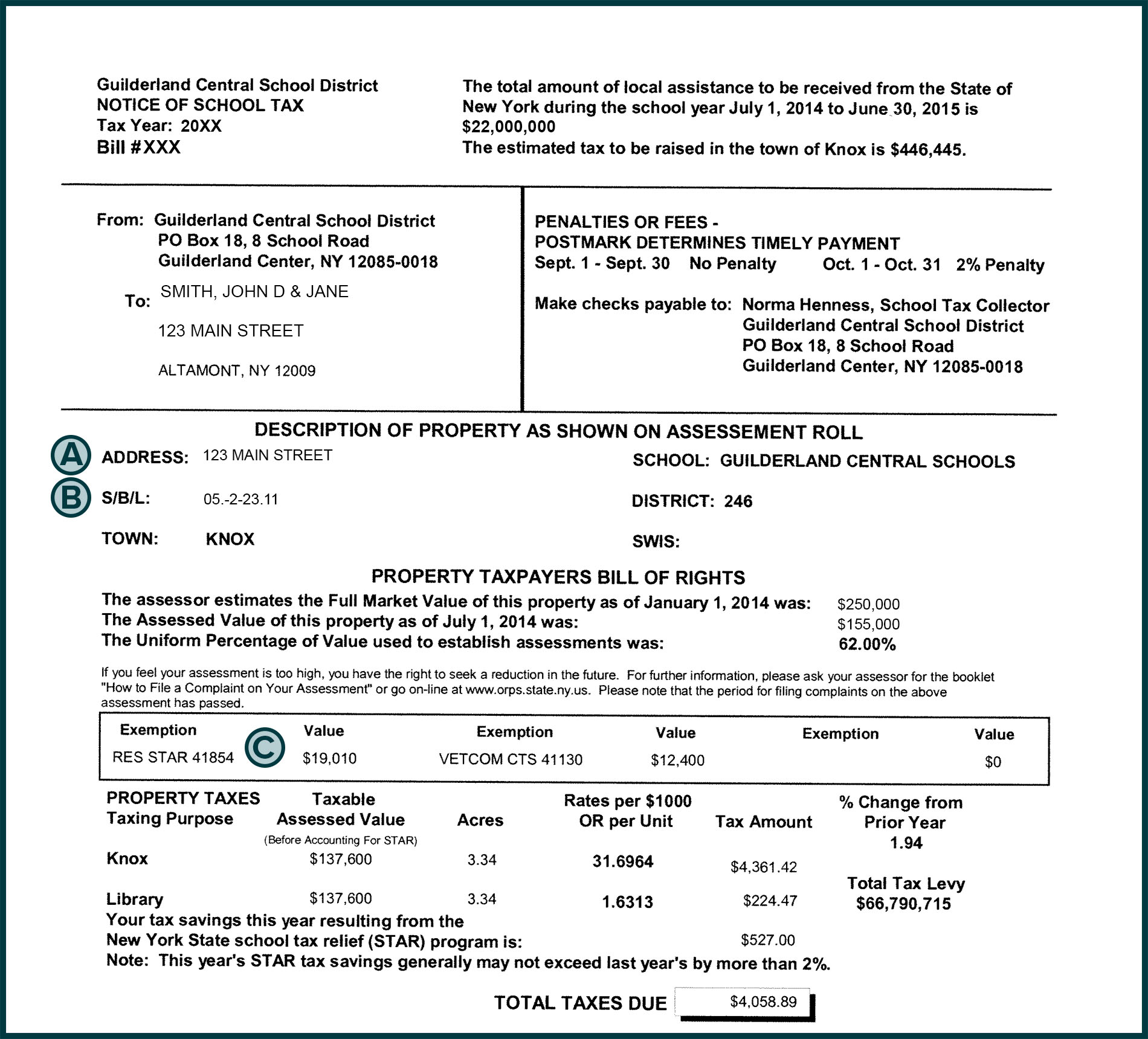

Alright, let’s start with the basics. A Loudoun tax assessment is essentially an evaluation of your property’s value by the county government. This value determines how much you’ll pay in property taxes each year. Think of it as the government putting a price tag on your home—or business, if that’s what you own. The assessment process happens regularly, usually annually, to ensure the county has an accurate picture of property values across Loudoun.

Why Does Loudoun Tax Assessment Matter?

Here’s the deal: your property tax bill is directly tied to the assessed value of your property. If your home is assessed at a higher value, you’ll pay more in taxes. Conversely, a lower assessment could mean lower taxes. So, understanding this process isn’t just about being informed—it’s about protecting your finances.

Additionally, property assessments impact the local government’s budget. The money collected from property taxes funds essential services like schools, public safety, infrastructure, and more. So yeah, it’s kinda a big deal.

How is Loudoun Tax Assessment Calculated?

The calculation of your property tax assessment involves several factors:

- Market Value: The current value of your property based on recent sales of similar homes in your area.

- Improvements: Any renovations or additions you’ve made to your property can increase its assessed value.

- Location: Properties in prime locations often have higher assessments.

- Tax Rate: The county’s tax rate, which is applied to the assessed value to calculate your final tax bill.

It’s not as simple as slapping a number on your house and calling it a day. The assessors take a lot of factors into account, and it’s all done according to strict guidelines set by Loudoun County.

Understanding the Loudoun County Tax System

Now that we’ve covered the basics of tax assessment, let’s zoom out a bit and look at the broader Loudoun County tax system. This will give you a clearer picture of how everything fits together.

Read also:Mastering Remote Iot Batch Job Examples On Aws Your Ultimate Guide

Key Players in the Assessment Process

In Loudoun County, the assessment process involves several key players:

- Assessor’s Office: This is the team responsible for evaluating property values. They use data, inspections, and market trends to determine assessments.

- Tax Commissioner: Once assessments are finalized, the Tax Commissioner calculates your actual tax bill based on the assessed value and the current tax rate.

- Appeals Board: If you disagree with your assessment, you can file an appeal. The Appeals Board reviews your case and makes a final decision.

It’s important to know who’s involved because it helps you understand where to go if you have questions—or if you need to challenge your assessment.

Factors Influencing Loudoun Tax Assessments

Several factors can influence your property’s assessed value:

- Market Conditions: A booming real estate market can lead to higher assessments, while a downturn might result in lower values.

- Location: Homes in desirable neighborhoods or near amenities like schools and parks tend to have higher assessments.

- Property Condition: Well-maintained properties with modern features are often assessed at higher values.

- Local Economic Trends: Economic growth or decline in Loudoun County can also affect property values.

These factors highlight why assessments can vary significantly from one property to another, even within the same neighborhood.

How to Prepare for Your Loudoun Tax Assessment

Being proactive is key when it comes to Loudoun tax assessments. Here’s how you can prepare:

Step 1: Review Your Property Records

Make sure the county has accurate information about your property. Check details like square footage, number of bedrooms, and any recent renovations. If there are discrepancies, contact the Assessor’s Office immediately to get them corrected.

Step 2: Keep Track of Market Trends

Stay informed about real estate trends in your area. Knowing how similar properties are selling can help you anticipate changes in your assessment.

Step 3: Understand Your Rights

You have the right to appeal your assessment if you believe it’s unfair or inaccurate. Familiarize yourself with the appeals process so you’re ready to act if needed.

By taking these steps, you’ll be better prepared to handle your Loudoun tax assessment with confidence.

Common Misconceptions About Loudoun Tax Assessments

There are a few myths floating around about property tax assessments that we need to clear up:

- Myth 1: Your assessed value is the same as your market value. Nope! While they’re related, they’re not always the same.

- Myth 2: You can’t appeal your assessment. Absolutely false! You have every right to contest an unfair assessment.

- Myth 3: Renovations always increase your taxes. Not necessarily. Some improvements might not significantly impact your assessment.

Now that we’ve busted these myths, you can approach your Loudoun tax assessment with a clearer understanding.

How to Appeal a Loudoun Tax Assessment

If you feel your assessment is too high, don’t panic. You can file an appeal. Here’s how:

Gather Evidence

Collect data to support your case. This could include:

- Recent sales of comparable properties in your area.

- Photos or reports showing any issues with your property that might lower its value.

- Documentation of any errors in the county’s records.

File Your Appeal

Submit your appeal to the Loudoun County Assessor’s Office within the specified timeframe. Make sure to include all the evidence you’ve gathered.

Attend the Hearing

If your appeal moves forward, you’ll have the opportunity to present your case before the Appeals Board. Be prepared to explain why you believe your assessment is unfair.

Appealing your assessment might sound daunting, but with the right preparation, it’s totally doable.

Tips for Reducing Your Loudoun Property Taxes

Who doesn’t want to save money? Here are a few tips to help you reduce your Loudoun property taxes:

1. Check for Errors

Go over your assessment notice carefully. Mistakes happen, and catching them could save you big bucks.

2. Take Advantage of Tax Exemptions

Loudoun County offers various exemptions for homeowners, seniors, and veterans. See if you qualify for any of these programs.

3. Stay Informed

Keep up with changes in tax laws and assessment practices. Knowledge is power, especially when it comes to your finances.

Implementing these strategies can help you keep more money in your pocket.

How Loudoun Tax Assessments Compare to Other Counties

Curious how Loudoun stacks up against neighboring counties? Let’s take a look:

Loudoun vs. Fairfax

Both counties have robust tax systems, but Loudoun tends to have higher property values due to its rapid growth and desirable locations.

Loudoun vs. Prince William

Prince William County generally has lower property values, which can translate to lower tax bills. However, Loudoun’s strong economy and excellent schools often justify the higher assessments.

Comparing counties can give you a better perspective on how your taxes stack up.

Future Trends in Loudoun Tax Assessments

As Loudoun County continues to grow, expect some changes in the tax assessment landscape:

Increasing Property Values

With more people moving to Loudoun, property values are likely to rise, which could lead to higher assessments.

Technological Advancements

The county is investing in new technologies to improve the assessment process, making it faster and more accurate.

Staying ahead of these trends will help you anticipate future changes and plan accordingly.

Conclusion

And there you have it—a comprehensive guide to Loudoun tax assessments. Whether you’re a seasoned homeowner or a first-time buyer, understanding this process is essential. By knowing how assessments are calculated, preparing for them, and taking advantage of available resources, you can manage your property taxes with ease.

So, what’s next? We encourage you to take action. Review your property records, stay informed about market trends, and don’t hesitate to appeal if you believe your assessment is unfair. Your wallet will thank you!

Got questions or thoughts? Drop a comment below, and let’s keep the conversation going. And while you’re here, why not check out some of our other articles? There’s always more to learn!

Table of Contents

- What is Loudoun Tax Assessment?

- Understanding the Loudoun County Tax System

- How to Prepare for Your Loudoun Tax Assessment

- Common Misconceptions About Loudoun Tax Assessments

- How to Appeal a Loudoun Tax Assessment

- Tips for Reducing Your Loudoun Property Taxes

- How Loudoun Tax Assessments Compare to Other Counties

- Future Trends in Loudoun Tax Assessments

- Conclusion