Ever wondered how property values are determined in Okaloosa County? Well, buckle up because we’re diving deep into the world of property appraisals, and trust me, it’s more exciting than you think. If you’re planning to buy, sell, or just understand the value of your property in Okaloosa County, Florida, this guide is your golden ticket. From understanding the role of the property appraiser to uncovering the secrets of property valuation, we’ve got you covered. So, let’s get started!

Property appraisal isn’t just about numbers; it’s about fairness, transparency, and ensuring everyone pays their fair share of taxes. The Okaloosa County Property Appraiser plays a pivotal role in this process, and understanding their work can save you from unnecessary headaches. Whether you’re a homeowner, investor, or just curious, this article will break down everything you need to know.

Think of the property appraiser as the unsung hero of the real estate world. They ensure that property values are assessed accurately, which directly impacts your tax bill. So, if you’re ready to unravel the mysteries of property valuation in Okaloosa County, keep reading. Let’s make sure you’re armed with the knowledge to make informed decisions.

Read also:Dermott Brereton Wife The Untold Story Behind The Man And His Life

Understanding the Role of the Okaloosa County Property Appraiser

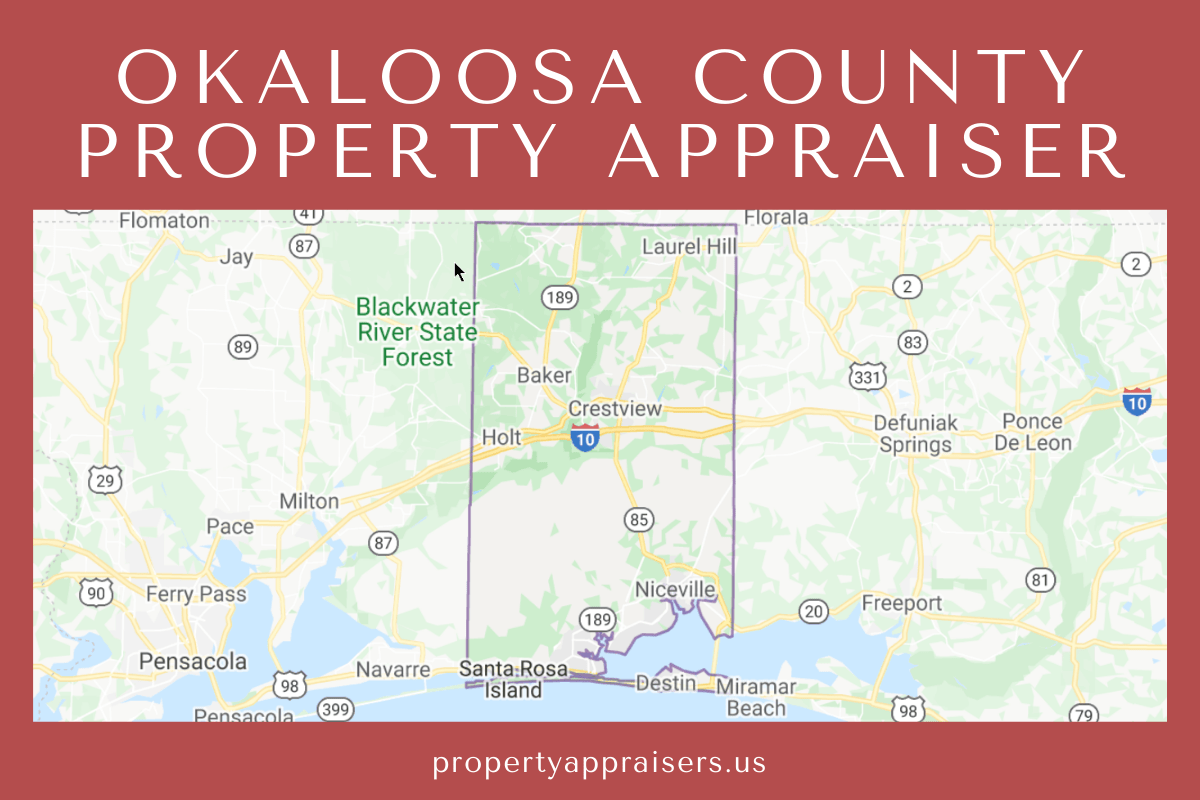

Alright, let’s get down to business. The Okaloosa County Property Appraiser is more than just a title; it’s a crucial position that affects every property owner in the county. But what exactly does the property appraiser do? Simply put, they’re responsible for assessing the value of all properties within the county. This includes residential homes, commercial buildings, and even vacant lands.

Now, you might be wondering why this matters. Well, the assessed value of your property determines how much you’ll pay in property taxes. So, if the appraiser gets it wrong, you could end up paying too much—or too little. And trust me, no one wants to be on the wrong side of that equation.

What Does the Property Appraiser Actually Do?

Let’s break it down. The property appraiser’s job involves several key tasks:

- Conducting property assessments to determine market value.

- Ensuring all properties are assessed fairly and uniformly.

- Maintaining accurate property records.

- Providing information to property owners and government agencies.

It’s like being a detective, but instead of solving crimes, they’re solving property value mysteries. And let’s be honest, that’s pretty cool.

How Property Values Are Determined in Okaloosa County

Alright, so how exactly do they figure out how much your property is worth? It’s not as simple as slapping a number on your house and calling it a day. The property appraiser uses a combination of methods to determine property values, and it’s a lot more scientific than you might think.

The Three Main Approaches to Valuation

There are three primary methods used to assess property values:

Read also:Hdhub4ugame Your Ultimate Destination For Highquality Entertainment

- Market Approach: This involves comparing your property to similar properties that have recently sold in the area.

- Cost Approach: Here, the appraiser estimates how much it would cost to rebuild your property from scratch.

- Income Approach: This method is mainly used for commercial properties and calculates value based on the income the property generates.

It’s like a recipe, where each ingredient plays a vital role in creating the final dish. And just like a good recipe, the appraiser combines these methods to come up with a fair and accurate valuation.

Why Accurate Property Valuation Matters

Let’s face it, property taxes aren’t anyone’s favorite topic. But they’re a necessary evil, and accurate property valuation ensures that everyone pays their fair share. If your property is overvalued, you could end up paying more taxes than necessary. On the flip side, if it’s undervalued, you might miss out on potential buyers if you ever decide to sell.

Think of it like a seesaw. When both sides are balanced, everything works smoothly. But if one side is heavier, things can get messy. That’s why the work of the Okaloosa County Property Appraiser is so important. They help keep that seesaw balanced.

The Impact on Property Taxes

Property taxes are calculated based on the assessed value of your property. So, if the appraiser gets the value wrong, it directly affects how much you’ll pay in taxes. And let’s be honest, no one wants to pay more taxes than they have to. That’s why it’s crucial to understand how the valuation process works and how it impacts your wallet.

Common Misconceptions About Property Appraisals

There are a lot of myths floating around about property appraisals, and it’s time to set the record straight. Here are some common misconceptions:

- Myth #1: The property appraiser sets your tax rate. False! The appraiser only determines the value of your property. Your local government sets the tax rate.

- Myth #2: Property appraisals are always accurate. While the appraiser strives for accuracy, mistakes can happen. That’s why it’s important to review your property’s assessed value regularly.

- Myth #3: You can’t dispute the appraiser’s decision. Wrong again! If you believe your property has been overvalued, you have the right to appeal the assessment.

It’s like a game of telephone. Sometimes the message gets twisted along the way, but with the right information, you can set things straight.

How to Appeal a Property Appraisal

So, what do you do if you think your property has been overvalued? The first step is to file an appeal with the Okaloosa County Value Adjustment Board (VAB). But before you do that, make sure you have all your ducks in a row. Gather evidence to support your claim, such as recent sales of similar properties in your area or any factors that might negatively impact your property’s value.

Think of it like preparing for a court case. The more evidence you have, the stronger your case will be. And who knows, you might just end up saving yourself a pretty penny.

Steps to File an Appeal

Here’s a quick breakdown of the steps involved in filing an appeal:

- Review your property’s assessed value and compare it to recent sales in your area.

- Gather evidence to support your claim, including photos, documents, and any other relevant information.

- Submit your appeal to the VAB by the deadline.

- Attend the hearing and present your case.

It’s like a puzzle, and every piece matters. Make sure you have all the pieces before you start assembling.

Property Appraisal Trends in Okaloosa County

Like everything else, property appraisal trends are constantly evolving. In recent years, Okaloosa County has seen a surge in property values, driven by factors such as population growth and increased demand for housing. But what does this mean for property owners?

Simply put, it means that property taxes are likely to increase as well. However, the appraiser’s office is working hard to ensure that these increases are fair and reasonable. They’re also implementing new technologies to improve the accuracy of property assessments, which is a win for everyone involved.

What the Future Holds

Looking ahead, the property appraisal process is expected to become even more advanced. With the help of AI and machine learning, appraisers will be able to analyze data more efficiently and accurately. But don’t worry, the human touch will always be an essential part of the process.

It’s like adding a turbocharger to a car. The basics are still the same, but with a little extra power, things just run smoother.

Resources for Property Owners

If you’re a property owner in Okaloosa County, there are plenty of resources available to help you understand the appraisal process. The Okaloosa County Property Appraiser’s website is a great place to start. It provides a wealth of information, including property records, tax information, and even a property search tool.

Think of it like a treasure hunt. The more you explore, the more valuable information you’ll find.

Where to Find More Information

Here are some additional resources to check out:

- Okaloosa County Property Appraiser’s Website

- Florida Department of Revenue

- Local Real Estate Agents

It’s like having a team of experts at your disposal. Use them wisely, and you’ll be well-equipped to navigate the world of property appraisals.

Conclusion: Your Key Takeaways

So, there you have it. The Okaloosa County Property Appraiser plays a vital role in ensuring fair and accurate property valuations. By understanding their role and how the valuation process works, you can make informed decisions about your property. Whether you’re buying, selling, or just trying to keep your tax bill in check, this knowledge is invaluable.

Now, it’s your turn to take action. Review your property’s assessed value, gather evidence if necessary, and don’t hesitate to appeal if you believe the assessment is unfair. And remember, knowledge is power. The more you know, the better equipped you’ll be to protect your investment.

So, what are you waiting for? Dive into the world of property appraisals and take control of your financial future. Your wallet—and your property—will thank you for it.

Table of Contents

- Understanding the Role of the Okaloosa County Property Appraiser

- How Property Values Are Determined in Okaloosa County

- Why Accurate Property Valuation Matters

- Common Misconceptions About Property Appraisals

- How to Appeal a Property Appraisal

- Property Appraisal Trends in Okaloosa County

- Resources for Property Owners

- Conclusion: Your Key Takeaways