What a difference a refinery makes!

Nigerians’ long wait for a refinery that ACTUALLY refines crude oil seems to be finally over, with the scheduled commissioning of the multi-billion dollar Dangote Refinery in Lagos in late May, 2023. It has been variously announced that, barring any unforeseen circumstance, the first drop of locally-refined Premium Motor Spirit (PMS), popularly known as petrol, as well as diesel, etc will be powering vehicles on Nigerian roads by the end of May. That, to say the least, is music to the ears of most Nigerians.

This event is akin to a dream come true – or, more accurately, the end of a nightmare. Until now, Nigeria’s lack of refining capacity (due to the non-operation of the country’s 4 existing government-owned refineries in Kaduna, Warri, Eleme and Port Harcourt) means that Nigerians have had to contend with rising energy prices – in particular, for petrol, diesel, kerosine and gas – due to the fact that the country imports these refined products on the International market, and is therefore subject to vagaries of forces over which we have no control – two recent cases in point being the Covid 19 pandemic, and the war in Ukraine.

The irony of this state of affairs is stark, if not tragic. In terms of daily crude oil output, Nigeria is the world’s 15th largest oil-producing country; No. 1 in Africa, and the 6th largest among the members of OPEC (the Organisation of Petroleum Exporting Countries). And yet, for years it has been heavily dependent on imported refined petroleum products to meet domestic need. Not only are the country’s four refineries not working – and here’s an even greater irony – the said refineries (multi-billion dollar investments established and funded with taxpayers’ money to start with) still receive generous government subventions, and still maintain a robust payroll of employees who draw fat monthly salaries and allowances, in spite of their comatose state.

In order to fill the supply gap created by these moribund refineries, the Nigerian federal government resorted, in the mid-1990s, to importing refined products. At the time, this measure was meant as an interim, stop-gap arrangement pending when government would complete a ‘turnaround maintenance’ (TAM) of said refineries. Over time, though, what was initially conceived as an ad-hoc arrangement eventually became normalized, even institutionalised, and still persists till date – with the expenditure of badly-needed but grossly inadequate foreign exchange to lubricate the business, a large part of which goes into the payment of ‘subsidies,’ which not only sustain the business, but are a major contributor to the progressive decline in the value of the naira against major world currencies. The haemorrhaging of the country’s treasury as a result of this anomaly has left the FG and some subnational governments unable to execute infrastructural projects or even meet such basic obligations as paying workers’ salaries on a regular basis.

It is with relief, therefore, that millions of Nigerians received the news of Dangote Refinery’s scheduled commencement of operations. The least they would expect now is a considerable reduction in the pump price of petroleum products – considering the fact that there is virtually no forex requirement for marketers (major or independent) to lift crude, as has obtained before now.

Officials of the Dangote Refinery say the facility is anticipating the arrival of its first batch of crude oil in June of 2023, to consist of 500,000 b/d, before progressively increasing to 650,000 b/d by mid-2024. Petrol production itself, according to these officials, is projected to rise from its current zero-status to over 240,000 barrels per day (b/d) by the year 2026, and over 300,000 barrels b/d by 2033. Conversely, petrol imports will decrease by over half to 154,000 b/d by 2026. At full capacity, the refinery is estimated to be able to process about 650,000 barrels of crude oil per day.

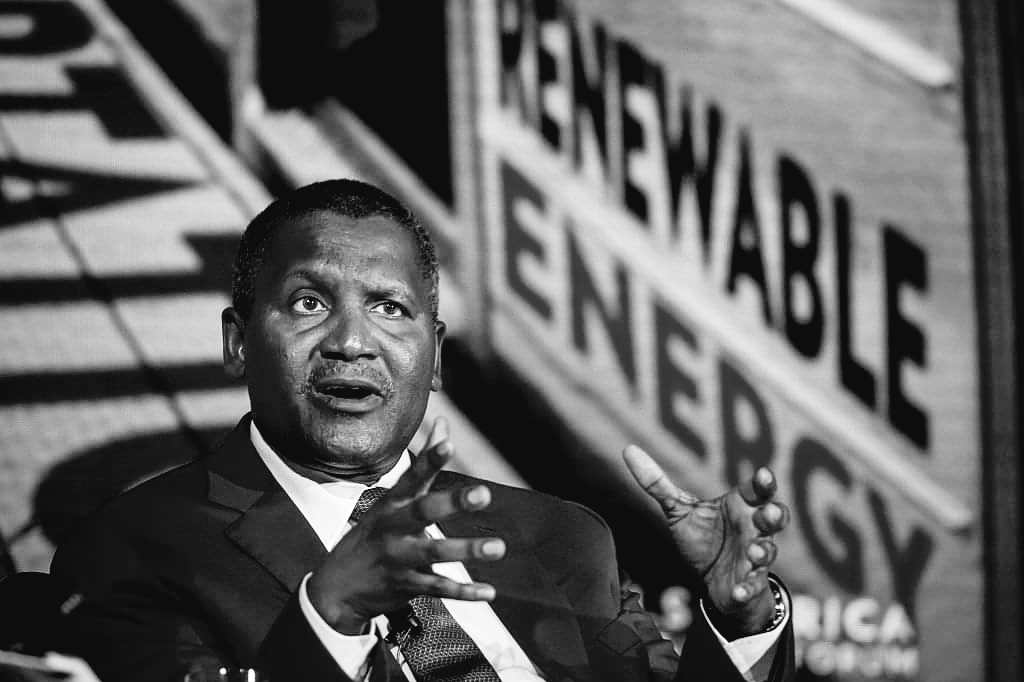

What impact – in the short, medium and long terms – will Alhaji Aliko Dangote’s intervention in the Nigerian energy ecosystem, as exemplified by this refinery, have on Nigeria’s energy, the international (and specifically, regional) oil and gas dynamics, and the fortunes of the Nigerian economy in general? Experts say Nigeria’s crude production is expected to maintain some level of stability at approximately 1.3 million b/d over the next ten years. The operations of the Dangote refinery, however, are anticipated to have a significant impact on oil exports, with forecasts indicating that this year, Nigeria will produce 1.46 million b/d and export 1.45 million b/d. But by 2027, despite a slight decline in projected production to 1.30 million b/d, oil exports will see a dramatic drop to 656,000 b/d – thanks to the operational impact of the Dangote refinery.

In addition, the refinery is expected to play a significant role in driving economic growth across the board in Nigeria, first by meeting the entire domestic demand for essential commodities like gasoline, diesel, polypropylene, kerosene, and aviation jet fuel. The management of the Dangote Refinery is quick to point out the facility’s potential to create a ripple effect that would stimulate and foster the development and expansion of additional industries and diverse economic sectors outside oil and gas; in particular, they say, production of crucial products such as naphtha and polypropylene would serve as a catalyst for the production of items such as cosmetics, plastics, textiles, and so forth.

The refinery also hopes to supply other African countries currently importing from Europe and the US, including South Africa – and the Latin American nations.

Located in the Ibeju-Lekki axis of Lagos State, the Dangote Refinery covers a land area of approximately 2,635 hectares, and is said to be the world’s largest single-train refinery (i.e. one that uses an integrated distillation unit, or one Crude Distillation Unit (CDU) to refine crude oil into various petroleum products, as against the use of multiple distillation units, as is the case with most big refineries). Equipped with a 435 mw power plant able to meet the total power requirement of 5 states in Nigeria, the facility is designed to process a large variety of crudes other than Nigerian crude – including many African and Middle Eastern crudes, as well as US Light Tight Oil.

So upbeat is the Chairman of the Dangote Group, Alhaji Aliko Dangote, GCON, about the prospects of the refinery that he goes as far as saying that it could save Nigeria as much as $10 billion in foreign exchange (much of which is being expended at present on fuel importation ) as well as generate another $10 billion in exports when operations commence. According to him, the Dangote Refinery Plant is a legacy project that will see Nigeria netting $21 billion per annum. In addition to supplying more affordable fuel domestically, he says, it would boost investment in the downstream sector of the Nigerian oil and gas ecosystem.

A massive engineering undertaking by any standard on the planet, the Dangote Refinery is a testament to the application of a classic business principle – the ability to see a problem or challenge simply as an opportunity to create, or add, value. Secondly, it is a testament to grit, persistence, and the will to plow on until the desired destination is reached, in spite of challenges – both foreseen and unforeseen. In spite of the seemingly interminable delays (and huge cost overruns that swelled the initial estimated cost of the project from $9 billion to $20 billion), other logistical bottlenecks that had beset the project – which was first proposed in 2014 – the Dangote Refinery is today a living, breathing and magnificent reality.

Most significantly, its completion is a tribute to the vision and tenacity of one remarkable individual, and his unflinching faith in the enormous and so-far untapped potential of his country’s economy. “Nigeria“, Dangote has said in the past, “is one of the world’s best-kept (investment) secrets. A lot of foreigners are not investing because they’re waiting for the right time. There is no right time. In Nigeria, the right time is now.”

He should know. Long recognised as Africa’s richest person (with an estimated net worth of $20bn) Dangote’s business acumen has never been in doubt, nor is his belief in the potential of Africa’s largest economy, as well as his ambition to invest extensively in Africa’s emergent economies and tap into an environment that has been described as ‘the next growth frontier.’ These instincts were bred in him from an early age. Born in Kano, the commercial hub of northern Nigeria, on the 10th of April 1957, Dangote grew up in a wealthy Hausa Muslim home. His parents were Muhammed Dantata and Mariya Sanusi Dantata; his grandfather was a successful trader of rice and oats in Kano. He was educated at the Sheikh Ali Kumasi Madrasa, followed by secondary schooling at Capital High School in Kano, and then Government College, Birnin Kudu. He eventually received a Bachelor’s degree in Business Studies and Administration from the legendary Al-Azhar University in Cairo, Egypt.

What is today known as the Dangote Group began as a small trading firm in 1977, the same year Dangote relocated to Lagos to start his illustrious business journey. By his own admission, the young Aliko received a loan from his uncle to begin trading in commodities such as bagged cement, rice, and sugar. Today, the Dangote Group is one of the largest conglomerates in Africa, with international operations in Benin, Ghana, Zambia, and Togo. From being a trading company, the Dangote has transited into the largest industrial group in Nigeria, with a workforce of over 11,000 people across Nigeria and beyond. Prior to its venture into crude oil, the Dangote Group already dominates the sugar market in Nigeria, with the products of its sugar refinery responsible for at least 70% of the national and regional market, with a large client and customer base – and servicing the demands of such entities as soft drink companies, breweries, and confectioners. The conglomerate encompasses such divisions as Dangote Sugar Refinery, Dangote Cement, and Dangote Flour. The Group also owns salt factories and flour mills, in addition to being a major importer of rice, fish, pasta, cement, and fertilizer. It is also an exporter of cotton, cashew nuts, cocoa, sesame seeds, and ginger. Other interests include real estate, banking, transport, and textiles – and in due course, these interests will be joined by automobile assembling (following the Group’s 2022 partnership with Stellantis Group, the parent company of Peugeot, and other key stakeholders. Named Dangote Peugeot Automobiles Nigeria Limited (DPAN) the factory, which is based in Kaduna, has begun operations in earnest.

One of the most significant challenges the Dangote Refinery is likely to face, going forward, is an unstable supply of crude oil. In recent years, Nigeria has struggled to exceed 1.2 million b/d – no thanks to prevailing insecurity, oil theft, strikes by oil-and-gas industry workers, as well as technical and operational issues at the oil wells themselves, some of which are already aging. Nigerian crude is globally described as ‘sweet crude’ – that is, it can be relatively easy to convert into fuel and therefore attracts a range of customers in Europe and Asia. No thanks to the above factors, however, traders have struggled to offload barrels of Nigerian crude. These issues, experts say, might militate against the ‘transformational’ nature of the refinery.

Another factor is the rapid population growth expected in Nigeria in the coming decades, which means that the importation of refined petroleum might again exceed local production by, say, the early 2040s.

Before now, there has also been much concern among industry stakeholders as to whether the Nigerian economy in general, as currently stands, has the ports and logistical capability to export and deliver refined products over long distances. But that concern has since been allayed somewhat by the fact that the Dangote Group ALREADY exports fertilizer to Latin America, and has a distribution network across West and Central Africa for cement. In time, perhaps, the same logistical template might be developed for its refined petroleum products.

Talking about transforming and disrupting the Nigerian energy value chain, the Dangote Refinery has, believe it or not, already spurred quite a bit of activity in the local refinery sphere, as a number of other companies have now shown eagerness to position themselves in that sector as well. In particular, a competitor operating in the sugar, flour, and cement sectors is reported to be eyeing a 200,000 b/d refinery to be located in Nigeria’s Niger Delta region. Should all these other (Dangote-inspired) investment plans come to fruition, Nigeria’s long-dormant refining sector could transform the N/Delta region’s oil flows in particular, and Nigeria’s energy profile as a whole.

The more, as they say, the merrier – thanks to the pacesetting Dangote Group.

An efficient transportation network is the answer to the concern about logistics, experts believe – not just in terms of export but also of conveying refined products from Ibeju-Lekki to fuel stations across the country. The data shows that pipelines remain the cheapest means of doing so – but that raises the question of how to protect and expand existing pipelines and lay new ones, etc., in the face of the unwholesome activities of vandals and oil thieves. This calls for a redoubling of their efforts by the nation’s security apparatus.

The Buhari Administration has, for the past eight years invested massively in rail transportation. In a situation where the use of pipelines is not in the equation, as their safety cannot be adequately guaranteed, rail transportation should be the next option, given that transporting a bulky, liquid and highly flammable commodity like oil on Nigerian roads no longer makes sense – whether in terms of economics, environmental protection or the safety of lives and property, and the need to enhance the longevity of roads in Nigeria. Smuggling across our borders is yet another issue the FG must work assiduously to curtail.

As Nigerians eagerly welcome the first pumps of locally-made refined petroleum for the first time in decades, they expect that this transformation, wrought by Dangote, will be the beginning of a turnaround in the fortunes of a nation yearning to match its huge potential with actual accomplishments, for the benefit of its people.